Featured DIY Articles

Deck Lighting Ideas and Tips: Illuminating Your Outdoor Oasis

How to light your deck for enjoyable evenings with family and friends. Inspiring deck lighting ideas! In This Article: Types

5 Common Fire Pit Mistakes to Avoid: A Homeowner’s Guide

Expert advice on how to plan and use a fire pit so you avoid common fire pit mistakes and get

How to Clean and Repair Metal Roofing

Expert advice on how to clean and repair metal roofing, including DIY tips on how to fix rust and patch

Deck Lighting Ideas and Tips: Illuminating Your Outdoor Oasis

How to light your deck for enjoyable evenings with family and friends. Inspiring deck lighting ideas! In This Article: Types of Outdoor Deck Lighting Deck

5 Common Fire Pit Mistakes to Avoid: A Homeowner’s Guide

Expert advice on how to plan and use a fire pit so you avoid common fire pit mistakes and get the most from it. In

How to Clean and Repair Metal Roofing

Expert advice on how to clean and repair metal roofing, including DIY tips on how to fix rust and patch leaks on metal roofs, and

Picture this: a serene and inviting outdoor space where you can relax in the soothing shade, shielded from the sun. A well-designed patio roof or shade structure can transform your backyard into a true oasis, providing both shelter and style in the form of a cozy relaxation nook, an alfresco dining area, or a picturesque spot for entertaining.

Why We’re Experts

Don Vandervort writes or edits every article at HomeTips. Don has:

Don Vandervort writes or edits every article at HomeTips. Don has:

• Over 30 years’ experience as a remodeler and builder.

• Written more than 30 home improvement books.

• Served as Senior Editor at Home Magazine

• Appeared as a segment host on HGTV’s “The Fix” for 3 seasons.

• Been a featured expert on MSN.com, US News, and many others.

• Learn more about the trusted HomeTips brand!

Popular Stories

How to Pour Concrete Footings & Piers

How to pour concrete footings and piers, with step-by-step instructions for building a form and ready-made concrete pier options. In This Article: Fiber-Tube Forms Ready-Made

A Portable Generator Can Save You When the Power Goes Out

Expert advice on emergency portable generators, including how to buy, set up and run them, and generator features, sizes, and necessary equipment. In This Article:

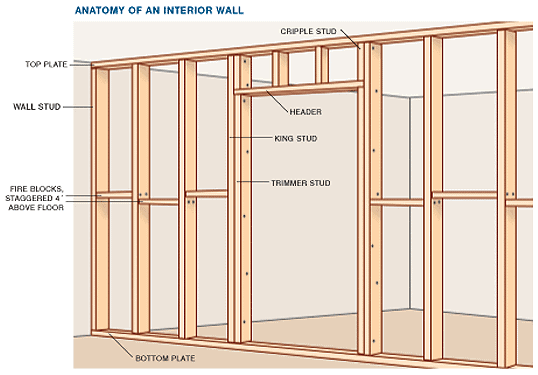

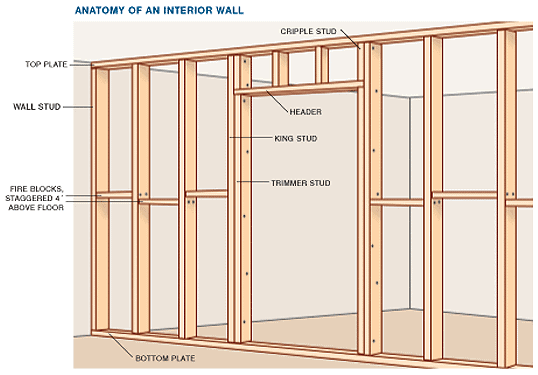

What Is a King Stud?

Want a definition of “king studs”? This article defines king studs, which are used for framing walls. It includes helpful diagrams that show where king

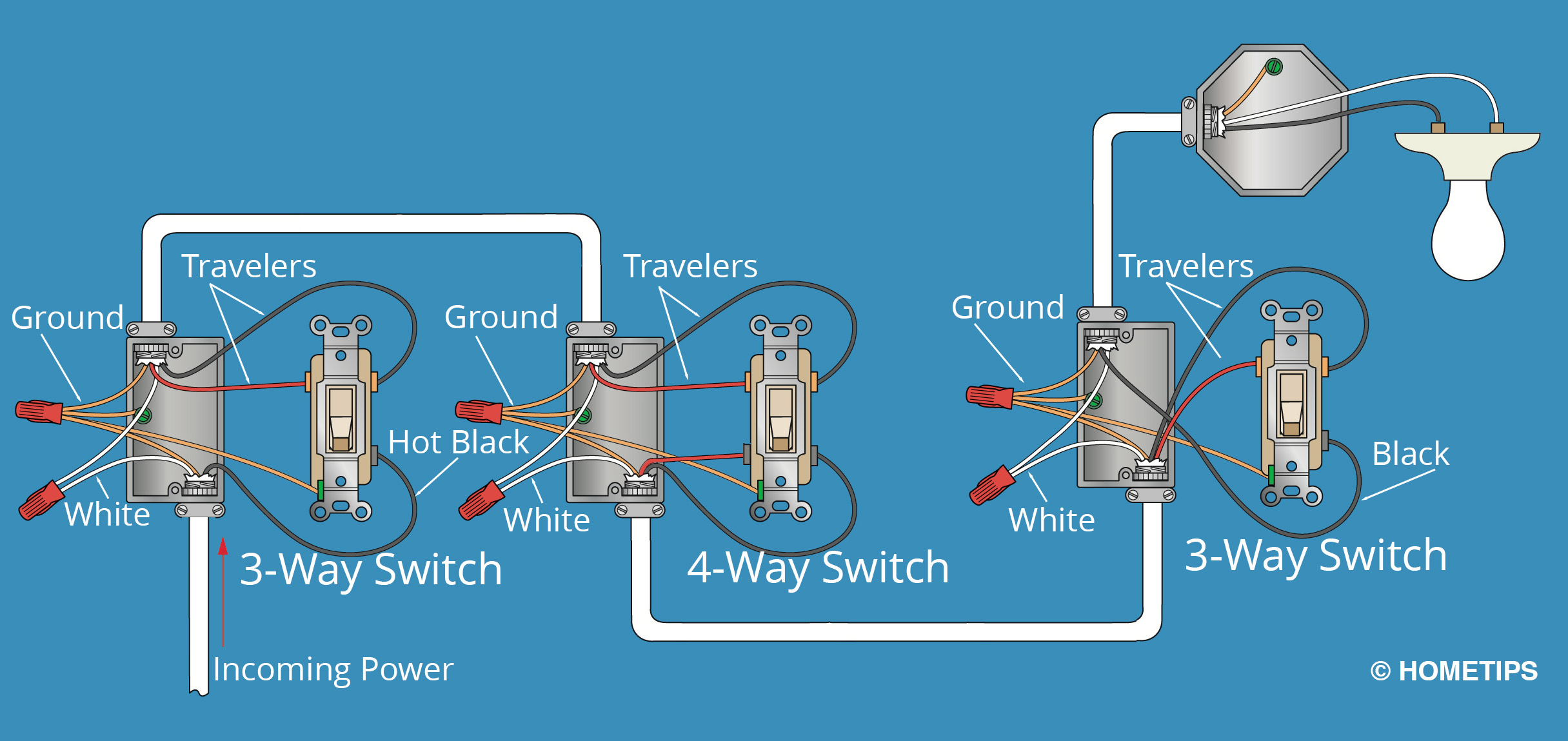

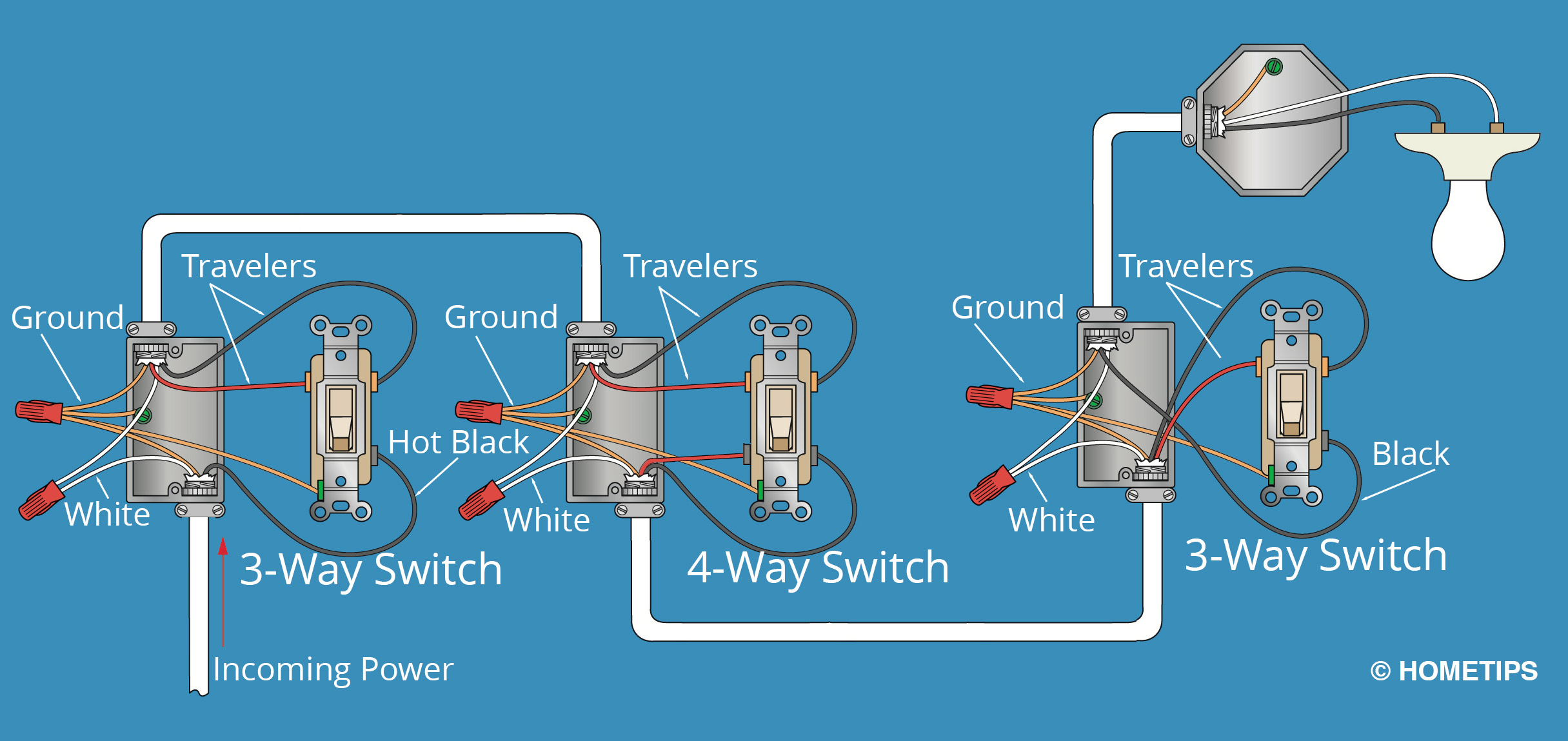

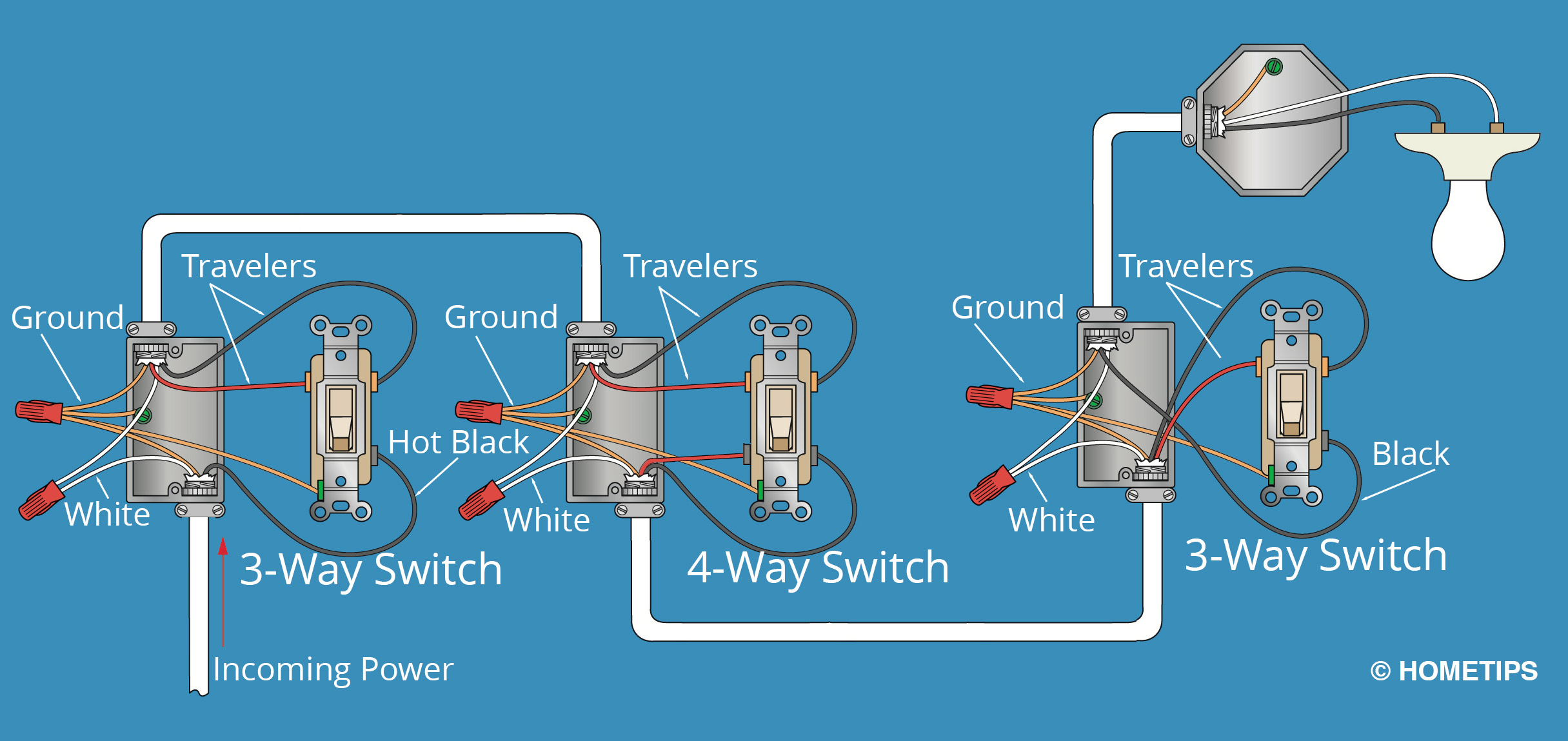

Four-Way Switch Wiring | How to Wire a 4-Way Switch

This article shows you how to wire a four-way switch that is combined with a pair of 3-way switches to allow controlling the same lights

All About

Rain Gutters

How to Buy Gutter Guards & Leaf Catchers

Gutter leaf guards, screens, and filters help prevent clogged, overflowing gutters. This expert buying guide will help you choose the right gutter guards, offering pros

How to Clean Gutters — DIY Guide

Expert illustrated advice and video on how to clean rain gutters, including DIY roof gutter cleaning techniques and how to hire a gutter cleaning service.

Other Featured Topics

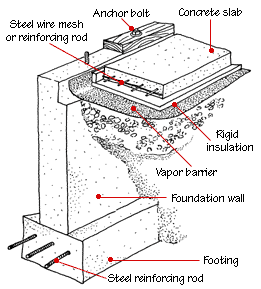

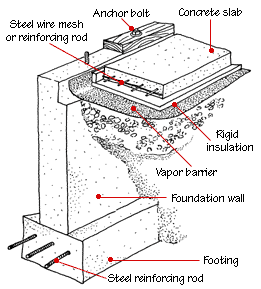

House Foundation Types and Diagrams

How basic foundations are built, including slabs, perimeter foundations, concrete blocks, and piers A house needs a foundation to shoulder its considerable weight, provide a

How to Build a Closet

Build a closet yourself, following these illustrated step-by-step techniques, including wall framing, paneling, and finishing. In This Article: Planning to Build Closet Walls Getting Started

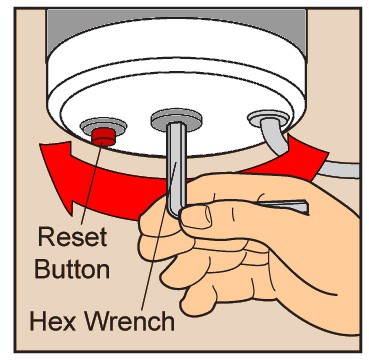

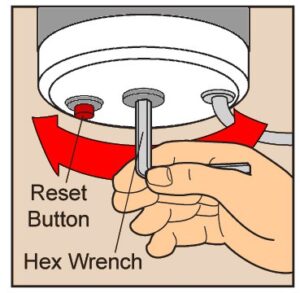

How to Fix a Garbage Disposal – DIY Repair

How to repair a garbage disposal that’s jammed, clogged, leaking, or not draining. Complete illustrated step-by-step garbage disposal troubleshooting and repair guide. In This Article:

How to Insulate an Attic

Whether your attic is finished or unfinished, this expert DIY guide will show you how to insulate it. Includes where insulation goes, the need for

Pros & Cons of Metal Roofing

Is metal roofing right for your home? This expert guide reveals the benefits and drawbacks of metal roofing and compares metal roofing to other roofing

House Foundation Types and Diagrams

How basic foundations are built, including slabs, perimeter foundations, concrete blocks, and piers A house needs a foundation to shoulder its considerable weight, provide a

How to Build a Closet

Build a closet yourself, following these illustrated step-by-step techniques, including wall framing, paneling, and finishing. In This Article: Planning to Build Closet Walls Getting Started

How to Fix a Garbage Disposal – DIY Repair

How to repair a garbage disposal that’s jammed, clogged, leaking, or not draining. Complete illustrated step-by-step garbage disposal troubleshooting and repair guide. In This Article:

How to Insulate an Attic

Whether your attic is finished or unfinished, this expert DIY guide will show you how to insulate it. Includes where insulation goes, the need for

Pros & Cons of Metal Roofing

Is metal roofing right for your home? This expert guide reveals the benefits and drawbacks of metal roofing and compares metal roofing to other roofing

Expand Your Knowledge

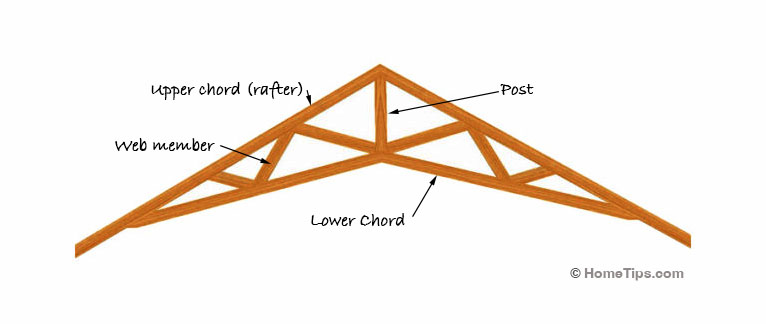

What Is a Scissor Truss?

What Is a King Stud?

How to Fix a Noisy Water Heater

Best Buying Advice

Design Secrets for Planning a Basement Bathroom

Inspired basement bathroom ideas and expert planning tips for creating stylish, smart, and functional basement bathrooms Facing today’s high real estate costs, many homeowners are

Expert Hacks for Remodeling Your Home Fast, Cheap, and Smart

Smart, expert hacks, tips, and strategies for controlling your budget and streamlining your home remodeling project. In This Article: Remodeling Hack #1: Reconfigure Existing Space

Basement Kitchen Ideas: Solutions for Design Issues

Expert basement kitchen design solutions for solving common issues with basement kitchens, such as low ceilings, poor lighting, and dampness. In This Article: How to

Four-Way Switch Wiring | How to Wire a 4-Way Switch

This article shows you how to wire a four-way switch that is combined with a pair of 3-way switches to allow controlling the same lights

All About Heating & Cooling Your Home

Watch Animag's Video Channel

Decorate Your Home

Design Secrets for Planning a Basement Bathroom

Expert Hacks for Remodeling Your Home Fast, Cheap, and Smart

Basement Kitchen Ideas: Solutions for Design Issues

Four-Way Switch Wiring | How to Wire a 4-Way Switch